Cost cutting came early to Barrie budget talks Wednesday night.

Facing only a 1.06 per cent property tax increase in the city’s portion of the 2024 operating budget, councillors essentially trimmed that away in one fell swoop.

Or at least the finance and responsible governance committee did, reducing the budget by $3.3 million and taking that increase close to zero.

“It doesn’t go unnoticed when there is additional pressure applied to go down to zero,” said Barrie Mayor Alex Nuttall, who moved the reductions, which still require general committee approval Nov. 29 and city council approval Dec. 6.

“(We want to) try to hold the city operations (property tax increases) to zero, but also put money aside to make sure that we’re not in a precarious position,” he said.

“I think it’s important that we do try to put some money aside (in city reserves), whether it’s for future capital projects or future operational costs, to make sure we're not leaving ourselves in a position where if something were to happen and we aren’t able to pivot immediately," the mayor added.

Nuttall’s cost cuts, compiled by city staff, would come in 16 areas, from reducing legal service costs to having less consulting and fewer contract services to charging fees for the use of city parks for weddings.

Costs would also be cut by eliminating a co-op student position in transit and parking, and advertising would be allowed in sports fields and courts to increase revenue.

And there’s $507,000 in potential savings in administrative monetary penalties rather than paying for court time.

But the largest savings would be $1.73 million by splitting the hiring of 20 firefighters in 2024 and 2025, rather than just next year, for Barrie Fire Station No. 6.

The land sale just closed for 1.8 acres at the southwest corner of Prince William Way and Mapleview Drive. With an 18- to 24-month construction phase, the station should be ready at the end of 2025 or early 2026.

City councillors should have little doubt how their constituents feel about property taxes. Oraclepoll Research did a phone survey of Barrie residents this past fall.

To maintain existing city service levels, respondents were asked if they were willing to pay slightly higher taxes. While 43 per cent said yes, 48 per cent said no and nine per cent were unsure.

Respondents were also asked if the taxes they pay to the City of Barrie are fair in relation to services received. While 44 per cent answered yes, 46 per cent said no and 10 per cent were unsure.

Oraclepoll’s survey of 1,000 adult Barrie residents took place Oct. 18 to Oct. 26, 2023 and the results have a margin of error of plus or minus 3.1 per cent.

How does the budget math work, admittedly early in the budget process, which extends until the end of January?

There’s a two per cent tax rate increase for infrastructure investment funding (IIF), used to replace and renew Barrie’s roads, pipes, buildings and bridges — half for tax-based infrastructure and the other half for stormwater infrastructure.

The IIF, formerly the dedicated infrastructure renewal fund (DIRF) and slated for a two per cent increase next year, would mean a $94.36 increase to the property tax bill for a typical home.

Driving next year’s tax increase on the city portion of the operating budget is a $9.2 million or 2.88 per cent hike in costs just to maintain Barrie’s service levels, although this is partially offset by an anticipated $6-million increase in property tax assessment next year. Nuttall’s reductions move it close to zero.

“The city is really seeing the impact of inflation, we are seeing that in the delivery of the services,” Craig Millar, the city’s chief financial officer and treasurer, said of financial pressure on the city.

Barrie’s user-rate budget for water requires a 3.97 per cent annual rate increase, or $15.42 more next year for a typical Barrie home. For wastewater (sewer), the rate increase would be 4.94 per cent, or $27.61 more for a typical home.

For a typical household that uses 180 cubic metres of water and wastewater annually, the 2023 cost of water services is $389 and for wastewater services $559. Those annual bills would increase to $404.42 and $586.61 respectively next year.

Still to come is the Barrie Police Service budget, scheduled to be presented in the new year.

City police typically comprise 20-plus per cent of city spending. And police spending is historically the largest portion of Barrie’s annual operating budget: this year it’s 22.1 per cent, it was 21.8 per cent last year and 22.2 per cent in 2021.

The County of Simcoe, another city service partner, supplies land ambulances and paramedics, health and emergency services, Ontario Works, children’s services, social housing, long-term care (LTC), seniors services and community services, which includes homelessness, to the city, which gets an annual bill.

All of this still needs to be calculated.

While municipal governments cannot pass deficit budgets, they can accumulate debt.

Barrie’s forecast debt level at the end of this year is $299 million, but it drops to $280 million next year, then it’s $294 million in 2025, $291 million in 2026, $287 million in 2027 and $277 million in 2028.

“For a growing municipality like Barrie, this is not unusual,” Millar said of the city’s debt.

Large 2024 debt items include almost $5.2 million for the city’s fleet renewal and $3.9 million for the wastewater treatment facility’s new advanced nutrient renewal system.

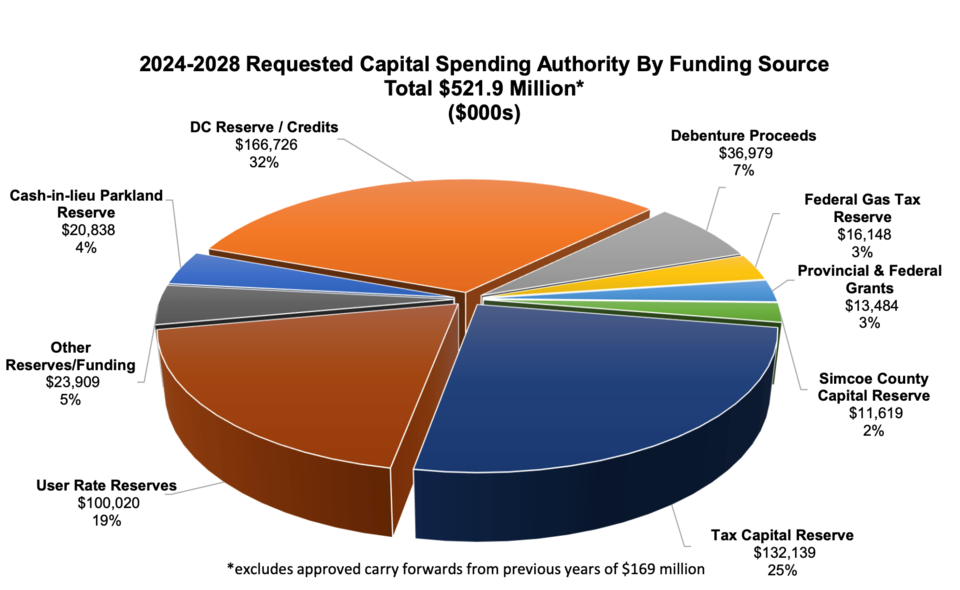

The city’s 2024 capital budget totals $691 million, including previously approved funding requests of $269 million, $253 million this year and $169 million in ongoing, multi-year costs.

Key capital projects in 2024 include the construction of Bryne Drive South from Harvie Road to north of Caplan Drive, building the Allandale and downtown transit mobility hubs, constructing Duckworth Street from Bell Farm Road to St. Vincent Street and the new transmission watermain and road expansion on Bayview Drive, from Little Avenue to Big Bay Point Road.

“We have many more needs and wants than we have financial resources,” Millar said of the capital budget. “We just don’t have the money to do it all.”

Capital spending is funded from a combination of property taxes, development charges, issuing debt, grants, user rates and reserves.

Development charges are designed to recover the capital costs associated with residential and non-residential (commercial, industrial, institutional) growth within a municipality from developers, so that existing residents don’t have to foot the bill for new residents.

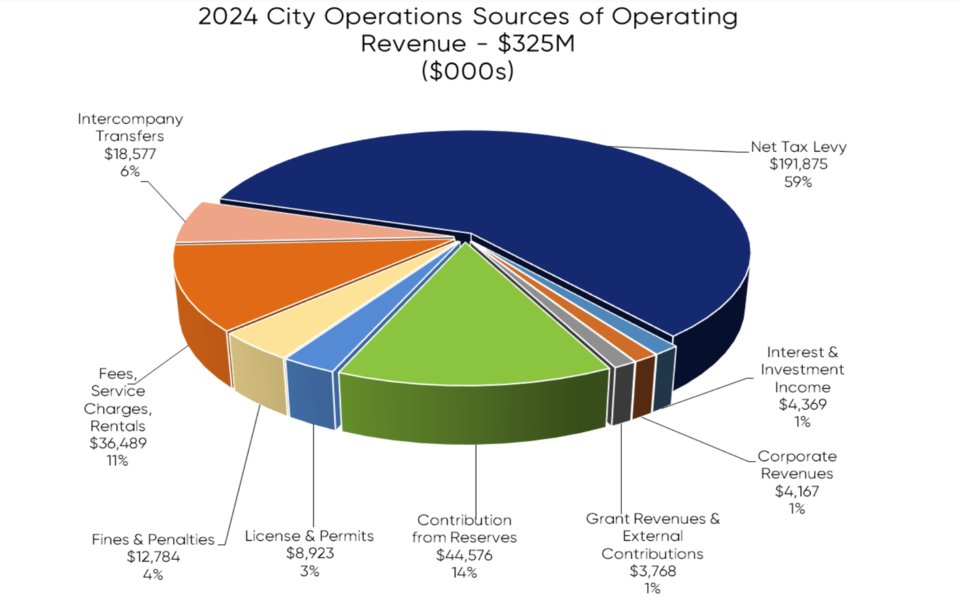

The 2024 tax-supported base operating budget for city operations and the IIF has gross expenditures of $325.5 million and a net property tax levy requirement of $191.9 million.

City staff presented the 2024 operating and capital budgets at tonight's finance and responsible governance committee meeting. Councillors will again discuss and make changes to the budgets at the Nov. 29 general committee meeting and are scheduled to give final approval to the city portions of the budgets at the Dec. 6 council meeting.

Service partners — Barrie police, County of Simcoe, Barrie Public Library — make their presentations to councillors on Jan. 17, 2024, then those budgets go to general committee on Jan. 24 and council on Jan. 31.

Only once the operating, capital and service partners budgets are approved will Barrie homeowners know the full extent of their property tax increase.

The city's 2023 operating and capital budgets resulted in a 2.89 per cent property tax hike for Barrie homeowners. On the typical Barrie home assessed at $365,040, that increase equalled $134 more this year — bringing its total taxes from $4,612 in 2022 to $4,746 in 2023.

Barrie’s annual operating and capital budgets not only set property tax rates, but levels for more than 60 services such as fire fighting, snow clearing, road repairs, transit, parks and recreation and water treatment.